Retirement income planning Charlotte NC

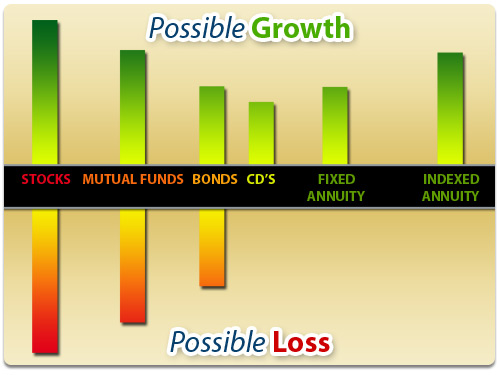

What's your Risk Tolerance?How are you planning for retirement income? What is your risk tolerance? To the right is an excellent example highlighting the risk/reward with many common retirement accounts. In this graph we see the indexed annuity is the only retirement account where your money grows without risking one dime. And with the indexed annuity you remain in control of your money.

What's your Risk Tolerance?How are you planning for retirement income? What is your risk tolerance? To the right is an excellent example highlighting the risk/reward with many common retirement accounts. In this graph we see the indexed annuity is the only retirement account where your money grows without risking one dime. And with the indexed annuity you remain in control of your money.

Is the risk really worth the reward with your current retirement income strategy?

Commonly overlooked factors in Retirement Income Planning:

Planning your retirement?

Planning your retirement?

Inflation - Since 1950 inflation has averaged slightly over 4%. If this were to continue a dollar today would purchase only 60 cents worth of goods and services in 10 short years! A $40,000 income today would have only $24,000 in real buying power. There is a solution for this problem.

Income Taxes - You may think that you have been getting a 6% return on your investments. But if you are in a combined federal and state tax bracket of 33%, you are really only getting a 4% return since 2% of your return is lost to income tax each year. A historical annual inflation rate of 4.2% means you may have been going backwards each year. There may be a solution for you.

Longevity - The census bureau reports people live much longer now than 50 years ago. The drawback to living longer is outliving your money. In the past you had 45 years to work and save for a comfortable 10 year retirement. Now you have 45 years to work and save for 20 or more years of retirement. You need a solution that will provide an income you can't outlive.

Social Security - Since 1935 the Social Security program allowed employees and employers to set aside money so employees can retire in dignity. Will Social Security change? Will Social Security alone allow you to retire in dignity? You know you should control your own retirement security.

- Myth 1 - Social Security benefits will probably never substantially change.

- In 1945 there were 42 people paying into Social Security for every one retiree. Today there are only 3.2 people paying into Social Security for every one retiree. Can this be sustained?

- Myth 2 - It is okay to assume low inflation risk.

- When planning for your retirement, it is safest to assume a 5% inflation rate.

- Myth 3 - Put all or most of your money in the bank where it is safe.

- The bank does protect you from risk to principal, but it does not protect you from interest rate risk. You should diversify your money among a variety of safe products that protect you from risk to principal, and risk of losing purchasing power due to inflation.