Indexed Annuities Information Charlotte NC

What makes Indexed Annuities unique? Your money is not invested directly in the market. You earn interest based based on the performance of a market index such as the S&P 500. Your principle and your earnings are guaranteed never to be lost. This means policy holders cannot lose money due to an unstable or plunging stock market. An indexed annuity is a harbor where your money can grow safely.

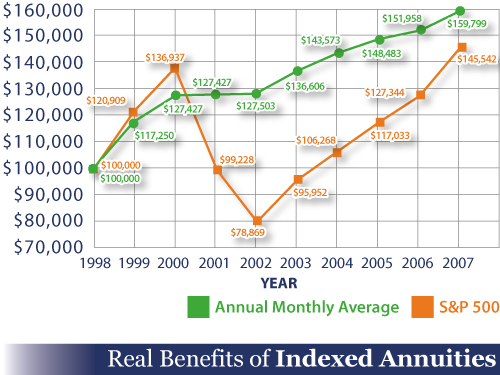

This graph maps the actual activity of an annuity indexed to the S&P 500 from 1998 to 2007. The value of the annuity is represented by the green line. As the value of the S&P 500 increased from 1998 to 2000 the annuity increases in value. From 2000 to 2002, the S&P 500 plunged but the indexed annuity maintained it's value. As the S&P 500 increased from 2002 to 2007 the value of the indexed annuity increased with the S&P 500.

Key Benefits of Indexed Annuities

Key Benefits of Indexed Annuities

- You cannot lose money due to an unstable market even when the market falls

- Interest earned is tax deferred

- Many indexed annuities have an immediate bonus on your money. Bonsuses range from 6% to 25% immediately added to your initial investment.

- The value of your annuity can increase when the market again moves upward

- No indexed annuity policy holder has lost a single penny as a result of the recent market tailspin. This is why annuities are an important part of most retirement plans.

Why should you buy an index annuity?

Indexed annuities provide the very safety you need in today's volatile markets. An indexed annuity will protect your money, and offer the opportunity to grow as the market grows back. An indexed annuity can provide a retirement income you cannot outlive.

Learn about other types of annuities: